- #Quicken 2015 home and business accounts receivable for mac

- #Quicken 2015 home and business accounts receivable upgrade

- #Quicken 2015 home and business accounts receivable software

- #Quicken 2015 home and business accounts receivable free

- #Quicken 2015 home and business accounts receivable windows

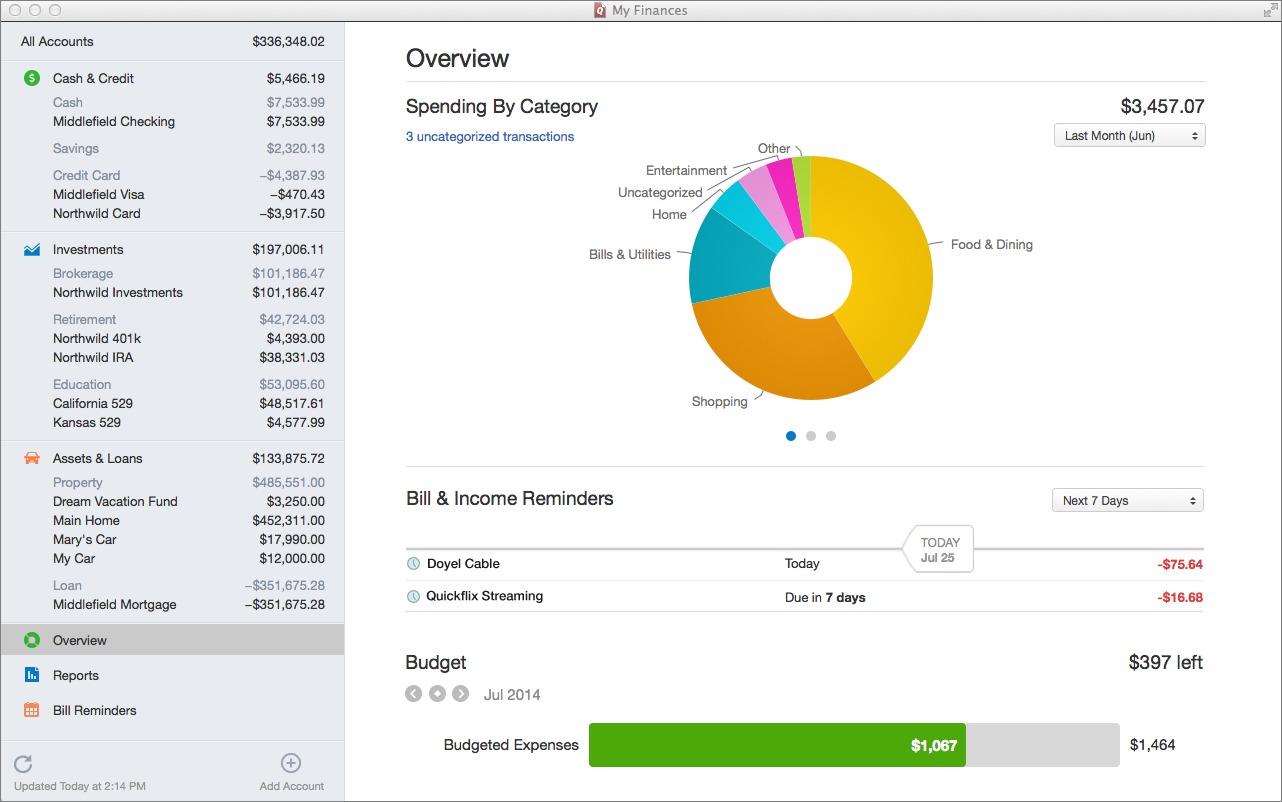

After creating an account online or on the mobile app, users can sync their bank accounts and credit cards with the Mint platform. Mint is perfect for individuals and families who want to gain a better understanding of how they are spending their money and then use that information to set new spending or saving goals for the future.

The key features include monthly bill payment tracking, a customizable budget planner, credit score monitoring, and options for various spending alerts. The software’s primary use is for personal budgeting. Mint can be used online or on the mobile app.

#Quicken 2015 home and business accounts receivable free

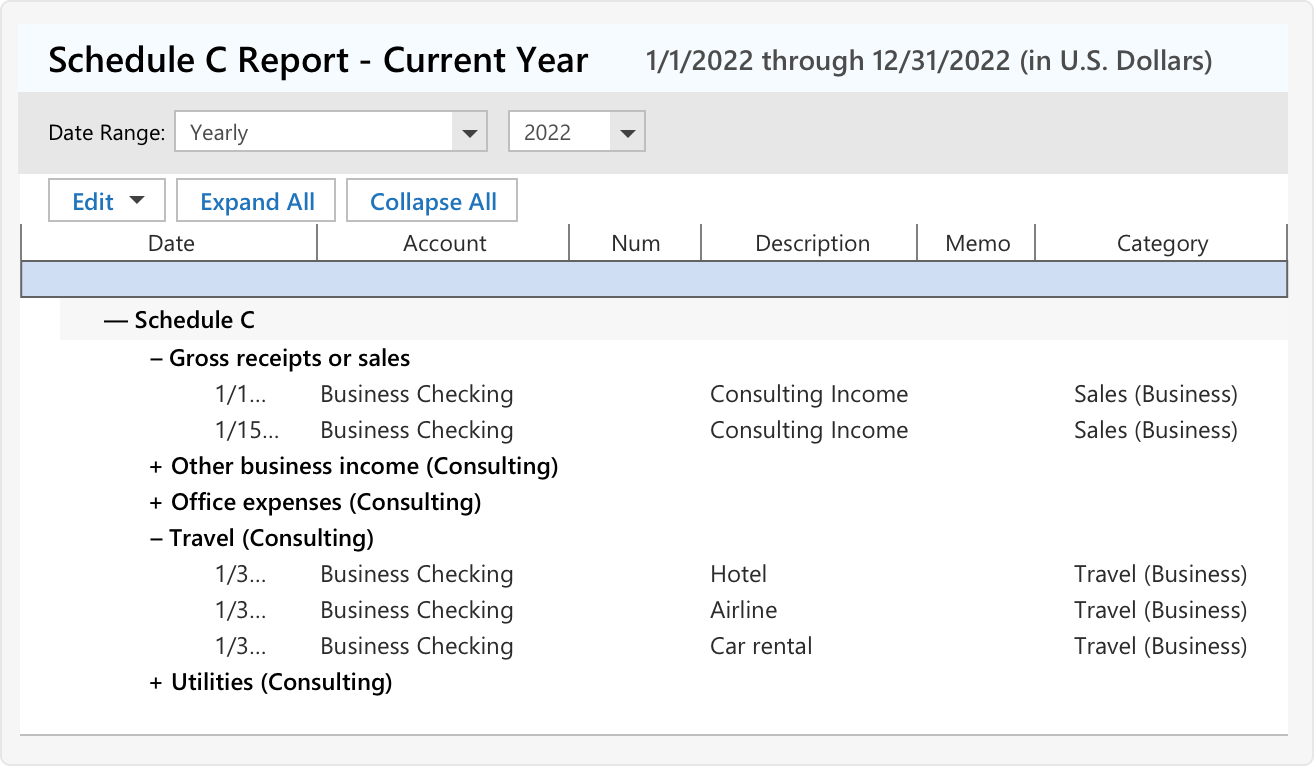

Mint is a free personal finance tool that launched in 2007 and was purchased by Intuit in 2009. Some syncing delays depending on your bank The business features can be accessed through the Home & Business plan and can run Schedule C and Schedule E tax reports and manage lease terms, rental rates, and security deposits. The more advanced plans add features such as investment, loan, retirement tracking bill pay and even basic business invoicing and tracking. The Starter plan allows users to track and categorize transactions and manage bills.

#Quicken 2015 home and business accounts receivable software

The software is downloaded onto a computer and data is stored locally, however, most key features can also be accessed using a web browser or the Quicken mobile app.

#Quicken 2015 home and business accounts receivable for mac

#Quicken 2015 home and business accounts receivable windows

#Quicken 2015 home and business accounts receivable upgrade

As a business grows and has more needs, it is easy to upgrade to the next level. The Simple Start plan is a great entry point for basic small businesses. All plans can be used online through a web browser and on the QuickBooks mobile app. The fee varies, depending on whether the client or the accountant is billed. Alternately, accountants who are registered with QuickBooks are able to offer their clients preferred subscription pricing. There are four levels of online cloud-based software available: It was founded in 2001 and has over seven million customers. QuickBooks Online, owned by Intuit, is the leader in accounting software for small businesses.

Key factors used in the consideration of the best accounting software included cost, ease of use, reputation, and functionality. We examined 13 software companies before settling on the five best accounting software solutions. By automating the process of tracking expenses, it is easier to collect and categorize tax-deductible expenses, which allows for major tax savings each year. One of the most important features of accounting software for businesses and personal finances is expense tracking. For families, accounting software is helpful for household budgeting, tax return preparation, retirement planning, investment tracking, and bill payment management. For businesses, accounting software can keep financial data organized and reduce the risk of human error, assist with budgeting, track inventory, and manage either accounts receivable or accounts payable tasks. Read our advertiser disclosure for more info.Īccounting software is an essential tool for managing business or personal finances. We may receive compensation if you visit partners we recommend. We recommend the best products through an independent review process, and advertisers do not influence our picks.

0 kommentar(er)

0 kommentar(er)